EMJ Capital CEO Eric Jackson has laid out one of the most aggressive long-term bitcoin targets in the space yet, arguing in an interview with reporter Phil Rosen that the cryptocurrency could reach $50 million per coin by 2041. His projection is tied to a thesis that bitcoin will evolve from “digital gold” into the core collateral layer of the global financial system.

Jackson said his thinking grows out of the same “hundred bagger” framework he used when buying beaten-down equities like Carvana. He recalled entering Carvana after its share price collapsed from around $400 to roughly $3.50 in 2022, at a time when sentiment was almost universally hostile. “You would hear things like, that’s run by a bunch of criminals. This is what a bunch of idiots. Like you’d have to be an idiot to let your company go from $400 this year to $450 or $350 rather,” he told Rosen.

Related Reading

For Jackson, that period illustrated how markets behave at extremes. “It’s human nature almost that when you’re in the moment of max pain or pessimism, you can only see what’s right in front of you,” he said. Yet the underlying product remained strong: “It wasn’t a broken platform. It wasn’t a broken service […] they would tell you they loved it. It was so easy. It was the best customer experience they had.” From there, he could “envision how they were going to be like a much more profitable business” once the company focused on profitability and addressed its debt.

Jackson’s Long-Term Thesis For Bitcoin

He applies the same long-horizon lens to bitcoin, arguing that the day-to-day ticker and polarized narratives obscure its structural potential. “We get so tied to turning on the TV and just seeing, like, what’s the price of Bitcoin today […] Some people are bearish and they say, oh, it’s a Ponzi scheme. And some people are bullish and they just, you know, throw these like kind of pie in the sky targets that you can’t really tie to reality,” Jackson said. “It’s kind of hard to latch on to like, what is the value of this thing?”

Jackson begins with the common “digital gold” framing. He asks how large the gold market is, how many central banks and sovereigns hold it and why. “Could Bitcoin be as big as gold one day? That seems like a safe assumption,” he argued, adding that because it is “digital” and “programmable” rather than a “hunk of rock,” younger generations may prefer it as a store of value. But he stresses that this is only part of the story, as bitcoin has not become a medium for daily transactions “since the guy who bought pizza with Bitcoin back in like 2011.”

The “penny dropped,” he said, when he began to think in terms of what he calls the “global collateral layer” that underpins borrowing by sovereigns and central banks. Historically, that base layer moved from gold to the Eurodollar system from the 1960s onward, and today is heavily intertwined with sovereign debt. “All the countries around the world issue debt and then they kind of borrow against that and they do their daily like government transactions,” he noted, but “there are problems with that.”

Related Reading

In Jackson’s “Vision 2041,” bitcoin replaces the Eurodollar and, functionally, becomes the neutral asset that other balance sheets are built upon. He argues that bitcoin is “much superior” as collateral because it is digital and “apolitical,” sitting outside central banks and the influence of “whoever the latest treasury secretary here is in the US.”

As with the Eurodollar, he does not see this as a direct attack on the dollar or Treasuries, but as a new underlying layer: “There’s some underlying thing that a lot of other countries and the financial systems borrow against to kind of do things.”

Eric Jackson (@ericjackson) expects bitcoin to hit $50 million by 2041.

He compares his thesis to how he knew Carvana, $CVNA, would be a 100-bagger stock pick. pic.twitter.com/CA9BWoR4zF

— Phil Rosen (@philrosenn) December 7, 2025

Looking ahead 15 years, Jackson envisions sovereigns that currently issue and roll debt instead “rely on Bitcoin,” because “over time, like that’s much more logical.” Given the “enormous” scale of the sovereign debt world, he argues that if bitcoin becomes the dominant collateral substrate, its price per coin would need to reach orders of magnitude above current levels—hence his $50 million-by-2041 target.

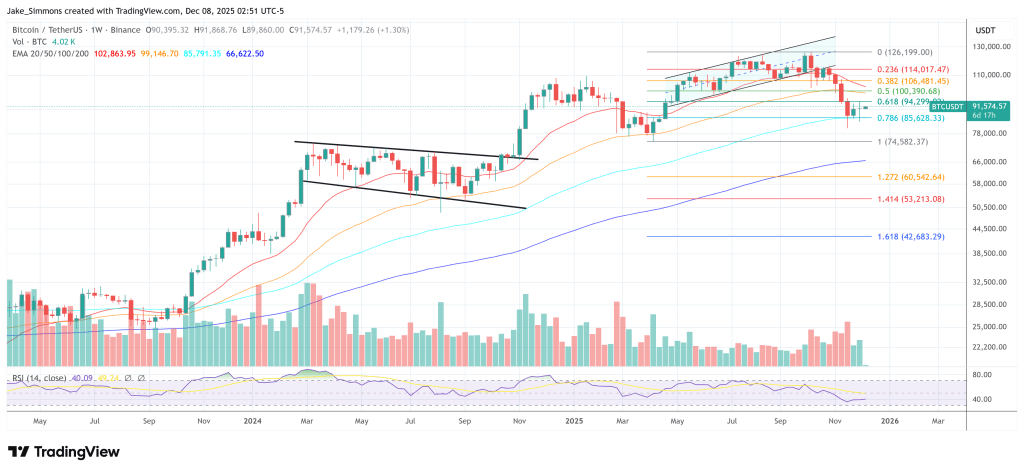

At press time, Bitcoin traded at $91,574.

Featured image created with DALL.E, chart from TradingView.com