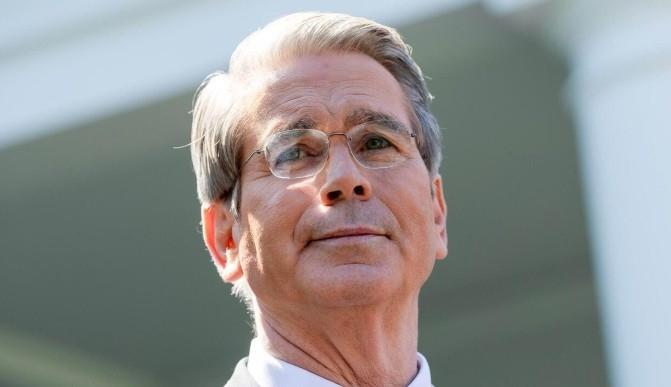

Scott Bessent

Mainstream

Amid the tumult following President Donald Trump’s April 2 “Liberation Day” tariff announcement, one encouraging development is that Treasury Secretary Scott Bessent has emerged as the lead spokesperson on trade negotiations. Bessent is highly qualified for the role, but is also tasked with finding quick solutions to complex issues while maintaining investor confidence in U.S. policies.

Bessent’s ascent is the direct outcome of the market turmoil that followed Liberation Day. When reporters asked him where the tariff negotiations were headed, his response was he did not know because he was not part of the negotiating team. This fueled rumors he might be looking to exit the administration, as MSNBC and The New Republic reported.

This was shocking, because the U.S. Treasury has led international economic negotiations since the collapse of Bretton Woods in the early 1970s. For example, Paul Volcker oversaw the transition from fixed exchange rates to flexible exchange rates then as undersecretary for international monetary affairs.

This time, Trump was mainly listening to Peter Navarro, his counselor for trade and manufacturing, whose views on trade are considered to be extreme by some members of the financial community.

Navarro backed the U.S. Trade Representative’s calculations of “reciprocal tariffs” that were computed by dividing a country’s bilateral trade surplus with the U.S. by its exports to the U.S. When he was asked in a CNBC interview why the formula did not take tariffs into account, he responded that a country’s trade imbalance with the U.S. is the direct measure of “unfair trading practices.”

The poor rollout of reciprocal tariffs caused the stock market to plummet and the dollar to weaken. It then spilled over to the Treasury market last week, when the 10-year Treasury yield surged by half a percentage point to 4.5%. This signaled that investors were losing confidence in U.S. policies.

The combination of higher bond yields and a weaker currency is rare for the U.S. The most important occurrence was October 1987, which I discuss in my book, “Global Shocks.” A dispute between the U.S. and Germany and Japan precipitated a dollar free fall and a spike in Treasury yields that culminated with the U.S. stock market plummeting by 22% in one day. The markets stabilized once policymakers patched over their differences.

To calm the markets this time, Trump responded by announcing a 90-day pause in implementing the reciprocal tariffs. The news was greeted with a powerful stock market rally.

Trump’s abrupt change occurred after Jamie Dimon called for Scott Bessent to take the lead on trade issues during a Fox Business appearance, as Bloomberg reported. Trump then responded by making Bessent the spokesperson on trade negotiations.

Bessent has since claimed to Fox Business that more than 70 countries have contacted the White House to discuss trade issues. However, many observers question whether Trump’s trade team can complete 90 deals in 90 days, according to Reuters.

The task ahead is daunting given the scope of the undertaking and the number of deals that need to be reached in a short time span. For example, Trump’s signature trade deal in his first term, the U.S.-Mexico-Canada Agreement, took 15 months to negotiate.

So, how might Bessent proceed?

In my view, he should begin by making it clear that the trade negotiations must be well conceived, as Trump cannot afford another April 2 fiasco.

One way to make the process manageable would be to cull the list of countries and exempt those that have little impact on U.S. trade overall. Another group that can be dealt with quickly are countries that have balanced trade, or which run deficits with the U.S. They include Australia, the U.K., Brazil, Singapore, Saudi Arabia and Israel.

Bessent is expected to begin by first dealing with Japan and South Korea that are seeking to resolve trade disputes quickly. Negotiations with Canada, Mexico and the European Union are likely to be more protracted.

The most difficult negotiations will be with China, where the trade conflict already has escalated far beyond any expectations: U.S. tariffs on Chinese goods are now at 145% and China’s tariffs on U.S. goods are at 125%.

While Trump said he wants to make a deal with China, President Xi Jinping has not responded to White House inquiries about negotiations and China’s Finance Ministry has called the level of tariffs a “joke,” Barron’s reported.

China has been preparing for a trade war ever since Trump launched one in his first term. Trump paused the conflict in return for a pledge that China would buy an additional $200 billion in U.S. goods. However, the Peterson Institute for International Economics reported that China bought only 58% of what it pledged. China appears prepared to ride out the storm this time, as well.

Meanwhile, Bessent must deal with the sheer magnitude of the tariff increases put forth by the Trump administration. The tariffs announced on April 2 would have boosted the effective tariff rate of the U.S. to a post-war high of about 22% from 2.5% previously. Now, with the added duties on Chinese goods, the effective tariff rate is 27%.

Yale’s Budget Lab model estimates the price hikes that accompanying these tariffs would raise the U.S. price level by 2.9% in the short run. This would boost costs for U.S. households by $4,700 on average.

If so, the outcome would be considerably different than what Bessent envisaged before he became Treasury Secretary, when he described Trump’s approach as “escalate to de-escalate” in a Financial Times report. Since the election, Bessent has modified his stance to bring it more in line with Trump’s position that tariffs could stay higher for longer.

The test ahead is what Bessent will do if investors become more concerned that tariffs will harm the U.S. and global economy. If he is unable to calm markets, he could fall out of favor with Trump and Navarro could once again become the spokesman on trade. That’s the kind of change investors would need to pay attention to.