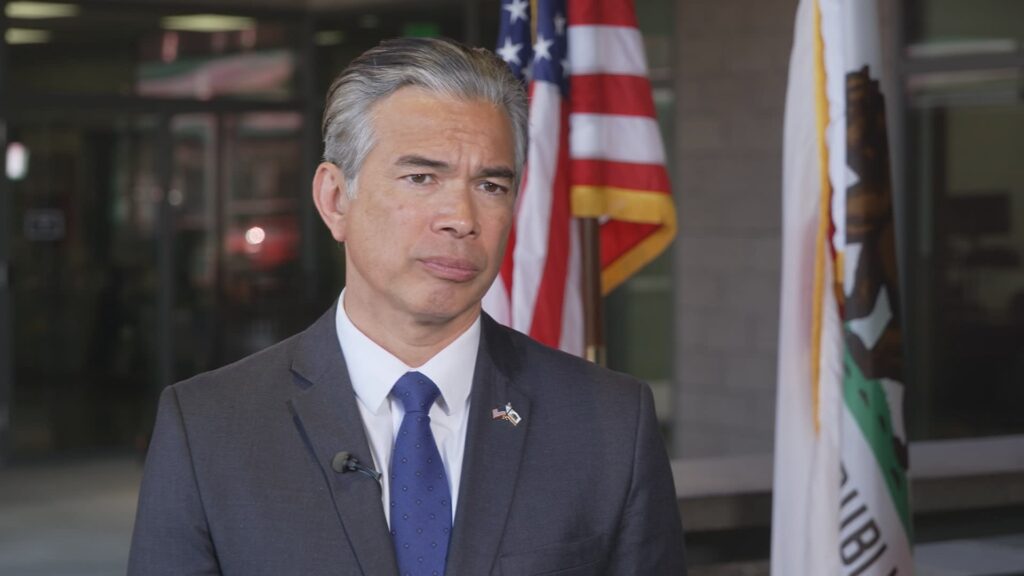

California Attorney General Rob Bonta speaks at a press conference in February 2024.

CNBC

A coalition of 22 attorneys general are opposing the Trump administration’s proposed regulation that could narrow eligibility for a popular student loan forgiveness program for government and non-profit workers.

The attorneys general registered their criticism in a letter to Education Department Secretary McMahon on Wednesday.

“Nationwide, millions of Americans took out student loans to become public servants with the promise of debt relief down the line, and now, the Trump Administration is attempting to hold this debt relief tool hostage from employers that engage in actions the President does not like,” California Attorney General Rob Bonta said in a statement.

The Public Service Loan Forgiveness program, which President George W. Bush signed into law in 2007, allows many not-for-profit and government employees to have their federal student loans canceled after 10 years of payments.

President Donald Trump signed an executive order in March that said borrowers employed by organizations that do work involving “illegal immigration, human smuggling, child trafficking, pervasive damage to public property and disruption of the public order” will “not be eligible” for PSLF.

More from Personal Finance:

Inflation is retirees’ ‘greatest enemy,’ says inventor of 4% rule

There’s still time for ‘super catch-up’ 401(k) contributions for 2025

Fewer people think retirement will ‘take a miracle,’ report finds

In August, the U.S. Department of Education issued a notice of proposed rulemaking on its regulations to halt loan forgiveness under PSLF for certain employees based on that executive order. In its proposed rule, the Education Department said the changes “may delay or prevent forgiveness for a subset of borrowers.”

People were given until Sept. 17 to comment on the proposed rules at Regulations.gov, and the attorneys general submitted their letter to McMahon on that deadline.

The U.S. Department of Education did not immediately respond to a request for comment.

The letter was signed by attorneys general of Arizona, California, Colorado, Connecticut, Delaware, the District of Columbia, Hawaii, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, Washington and Wisconsin.

Concern over who will be excluded

In their letter, the attorneys general wrote that the vagueness of the regulatory language will lead to uncertainty regarding which employers are eligible for PSLF, and grant the Trump administration broad authority to exclude programs it doesn’t approve of.

“If allowed to go into effect, ED could deem the State of California or specific California state agencies ineligible for PSLF, denying loan relief to state employees, and undercutting the state’s ability to recruit and retain skilled employees,” according to a press release from Bonta’s office.

Trump’s executive orders have targeted immigrants, transgender and nonbinary people and those who work to increase diversity across the private and public sector. Many nonprofits work in these spaces, providing legal support or doing advocacy and education work.

“Borrowers that work for those organizations are concerned,” Betsy Mayotte, president of The Institute of Student Loan Advisors, told CNBC in March.

Proposed rule is ‘unlawful,’ attorneys general say

The U.S Department of Education is trying to create “unlawful exceptions to Congress’s clear statutory command,” the attorneys general wrote in their letter.

When the program was created, Congress specified that PSLF would be available to any eligible borrower who has worked in government or a 501(c)(3) non-profit for a decade, they wrote.

Consumer advocates have made the same argument, and said that legal challenges to the rule were likely.

“The PSLF program, which was created by Congress almost 20 years ago, does not permit the administration to pick and choose which non-profits should qualify,” Jessica Thompson, senior vice president of The Institute for College Access & Success, told CNBC when Trump first signed the executive order on PSLF.

What student loan borrowers need to know

Experts say borrowers’ best option right now is to stay the course, assuming their current employer has previously been considered qualifying for PSLF.

That’s because it remains unclear exactly which organizations will no longer be considered a qualifying employer for PSLF under the Trump’s administration’s regulations. Some experts also say the changes to eligibility could be challenged in court.

Any overhaul of the PSLF program can’t be retroactive, Mayotte said.

That means that if you are currently working for or previously worked for an organization that the Trump administration later excludes from the program, you’ll still get credit for that time — at least up until the rule changes go into effect.