Even as some households take on more debt, consumer credit scores broadly remain strong. Experts say that may be masking signs of trouble: The so-called “K-shaped” economic divide has lower-income borrowers struggling to repay loans, as higher-income households have strengthened their finances.

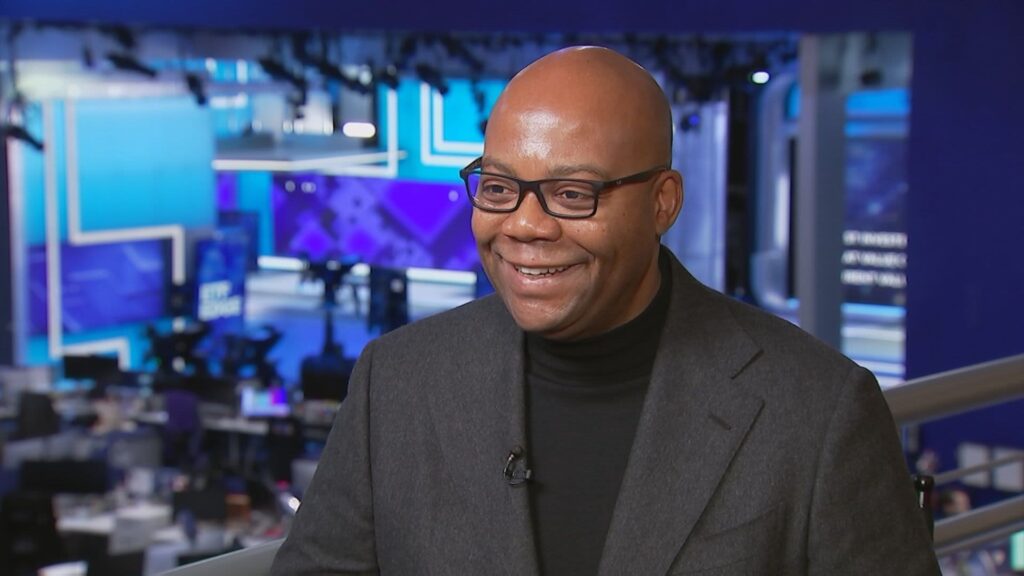

That divergence in consumers’ credit risk will likely continue into 2026, despite having a “pretty healthy” national average credit score, said Silvio Tavares, CEO of VantageScore, developer of one of the credit scores lenders use. It’s an independently managed joint venture of the three major credit bureaus — Equifax, Experian, and TransUnion.

The average VantageScore credit score was 701 in October, within a scale of 300 to 850. That’s steady from a month earlier, and down just one point from October 2024. The average score falls squarely in the “prime,” or second-best bucket.

Credit scores measure a consumer’s creditworthiness and predict the likelihood they’ll repay borrowed money. They’re based on credit bureau data. Borrowers with higher scores may have easier access to credit and are more likely to get a lender’s best rates.

The “prime tier” of credit scores has been shrinking over the past several months as some consumers move up to the “super prime” tier or down to near- or subprime tiers, VantageScore research found.

Lower-income households will likely continue to see delinquencies rise faster, while delinquencies may plateau for high earners, Tavares said, reflecting an increasingly polarized consumer economy.

“For high-income and middle-income consumers, their late payments they’ve actually dropped three of the last four months. But when you look at the lower-income consumers for that same period, their delinquencies have increased,” Tavares said. “So that’s a cause for concern as we finish out the holiday spending season, but it’s also a cause for concern for 2026.”

Late payments on credit cards, other loans expected to rise

Despite some economic uncertainty, a new report from TransUnion predicts that delinquency rates for most credit card and loan products will increase slightly but remain fairly stable in 2026. Fewer consumers have been late making payments in the past two years, which suggests that people have adjusted to a more normal spending routine coming out of the pandemic.

“Looks like people are over the hump of not knowing if they can afford their credit or not, or what to do with this extra cash flow that they’ve got, and that now they’re starting to settle into their normal buying patterns,” said Michele Raneri, vice president and head of U.S. research and consulting at TransUnion.

Tavares says job security could continue to affect the divergence in credit health between higher- and lower-income consumers in the year ahead. U.S. employers have announced 1.17 million jobs cuts through November of this year — the highest level since 2020, during the Covid pandemic, according to consulting firm Challenger, Gray & Christmas.

“As we look at 2026, the employment picture is going to be a key driver of consumers’ creditworthiness. There’s been much said about factors that are potentially decreasing employment, like artificial intelligence. We don’t actually see that in the numbers yet, and for the most part, the employment picture is very good,” he said.

How Federal Reserve rate cuts may help borrowers

Tavares said he is optimistic that as interest rates decline, more people will spend, creating more jobs and improving overall consumer credit health.

For borrowers seeking lower interest payments on loans, the Federal Reserve’s quarter-point rate cut this week may help, but only slightly. The Fed’s moves influence some products more than others. Plus, rates on debts such as mortgages and auto loans are often fixed for the life of the loan.

Borrowers with higher credit scores already tend to secure the lowest rates, Ranieri said.

Tavares said borrowers can take three simple steps to improve their credit scores: Make credit card and other loan payments on time, pay more than the minimum when you can, and use only a fraction of your available credit.

SIGN UP: Money 101 is an 8-week learning course on financial freedom, delivered weekly to your inbox. Sign up here. It is also available in Spanish.