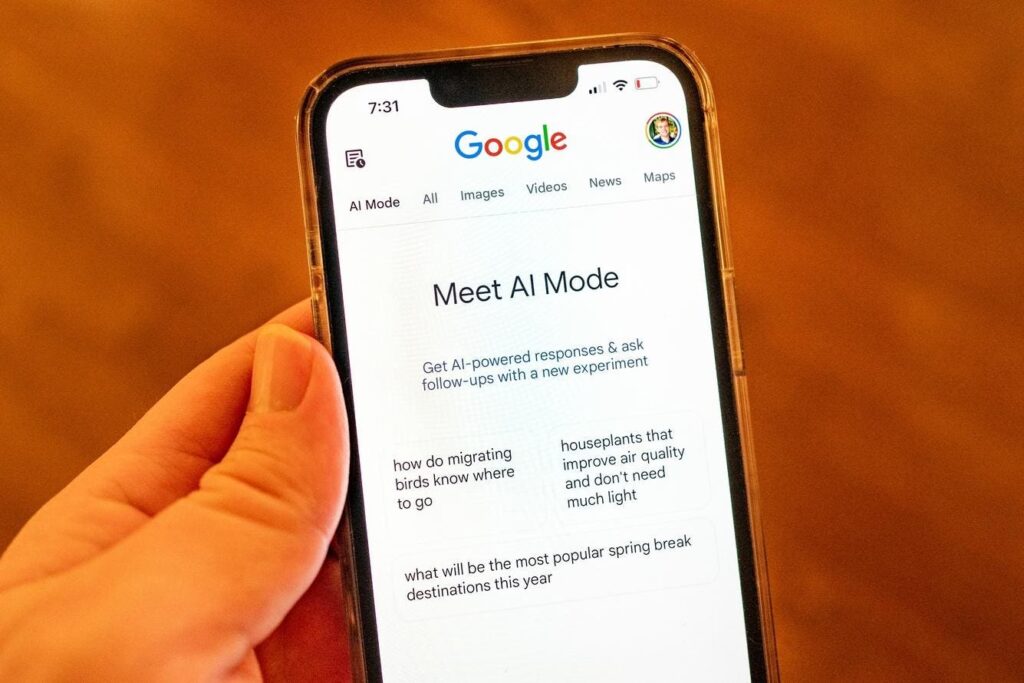

Close-up of a person’s hand holding an iPhone and using Google AI Mode, an experimental mode utilizing artificial intelligence and large language models to process Google search queries, Lafayette, California, March 24, 2025. (Photo by Smith Collection/Gado/Getty Images)

Gado via Getty Images

Google’s stock could rise 325% by 2035 if the company is broken up into five parts. However, the resulting loss of operating synergies could cost Google $67 billion in revenue lift and cost savings.

A judge is expected to order Google to take action after the company was found guilty in an antitrust trial, according to the Washington Post. Since the judge, Amit Mehta, could order Google to divest its Chrome browser, analysts have been estimating what Alphabet would be worth if it is split up.

To create an optimal outcome for investors and customers, Google may wish to pursue a strategic middle path with the following elements:

Spin off Waymo.

Separate Google Cloud into an independent entity.

Keep together Google’s consumer-focused services.

This approach would preserve the operational synergies of keeping the company partially together while boosting the company’s market value more than if Alphabet’s structure remains unchanged.

Google says a breakup would make the company worse off. “A combination of all the remedies makes it unviable to invest in research and development,” Alphabet CEO Sundar Pichai testified in April, according to the Post. The Justice Department’s proposed remedies would leave the “company’s intellectual property without value,” Pichai added.

I have contacted Google to request comment and will update this post if I receive a response.

Alphabet’s Breakup Value To Shareholders

Since Mehta could order Alphabet to divest Chrome, analysts have been speculating on Alphabet’s future value if the pieces of the company were independent.

If Alphabet is broken up into five independent businesses, they could be worth $3.7 trillion. Below are the valuations of the individual business units along with some key assumptions:

Search and Advertising ($2.4 trillion). This value applies Meta’s 9.7x revenue multiple over the last 12 months, according to FinanceCharts, to Google’s search and advertising’s $250 billion in annual revenue as an independent unit.

Chrome ($50 billion). Perplexity’s recent offer to buy Chrome for $34.5 billion is low based on analysts at Raymond James who value the browser at $50 billion assuming 2.25 billion users “and Google’s revenue share agreements with phone manufacturers that preinstall Chrome on devices,” notes CNBC.

Google Cloud ($575 billion). This is the midpoint of a high estimate of $602 billion (Wedbush) and a low one of $549 billion (TD Cowen), according to CNBC. DA Davidson gives Google Cloud an even higher $682 billion valuation based on its fast growth of 32% in the second quarter, about which I wrote at Forbes.

YouTube ($513 billion). This is the midpoint of a range between $475 billion and $550 billion set by MoffettNathanson which argues the video platform is “larger and more powerful than any other player in Hollywood,” CNBC wrote.

Waymo ($180 billion). This is the midpoint of a wide range of estimates. Oppenheimer valued the company at $300 billion – assuming $102 billion in 2024 adjusted earnings – while TD Cowen assigned a $60 billion valuation, CNBC reported.

The Loss To Customers Of Breaking Up Alphabet

This breakup analysis ascribes no value to the companies being under the same corporate parent – which ignores the substantial benefits of keeping the various units together.

For instance, there are network effects – meaning the more Google services a user adopts, the more valuable the individual services are to the user due to data sharing and integration among them.

In addition, profitable business units – think Search and Advertising – can fund experimental ones – such as Waymo during their development phases. Finally, as part of Alphabet, these units can negotiate lower prices with device makers, telecom service providers, and content partners.

These ecosystem benefits are worth an estimated $67 billion at the high end. Here are the biggest contributors:

Unified data intelligence: $30 billion in improved personalization and advertising effectiveness, according to Google Ads.

Cross-product integration: $25 billion from higher user retention and engagement, Google Ads noted.

Cost savings: $12 billion in operational efficiencies, based on the experience of the General Services Administration.

What Alphabet Should Do

To retain some of these synergies, Alphabet could pursue a strategic middle path that optimizes benefits to shareholders and customers, as follows:

Spin off Waymo. This would capture the premium valuations of autonomous vehicles while maintaining the service’s mapping data partnerships.

Separate Google Cloud into an independent entity — which would include service agreements for sharing corporate support services.

Maintain integrated consumer ecosystem – the bundle of Search, Chrome, Android, and YouTube – to preserve the user experience benefits outlined above.

This strategic middle path could more than double Alphabet’s stock market capitalization to about $6.9 trillion by 2035. This assumes a compound annual growth rate of 11% from AI-driven growth, a strong position in advertising, expanded ecosystem benefits, and capturing some of the premium benefits from the partial breakup.

Wall Street is modestly optimistic about the future value of Google’s stock. The 16 analysts who cover the stock estimate 8.8% upside given an average price target of $219, according to TipRanks.

The strategic middle path could produce an even better result for shareholders.