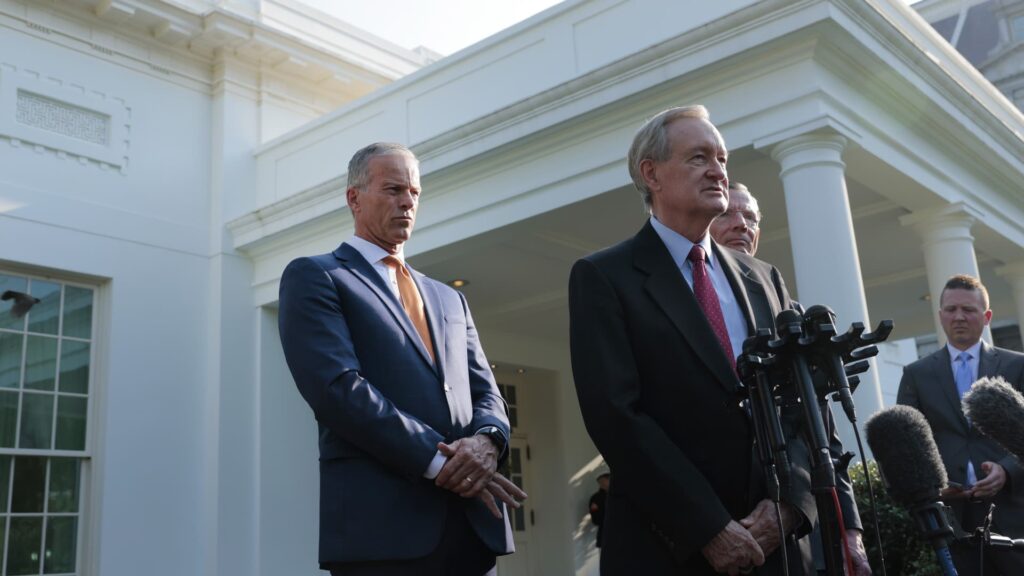

Senate Majority Leader John Thune (R-SD), left, listens to Sen. Mike Crapo (R-ID), center, chair of the Senate Finance Committee, speak to reporters outside of the West Wing of the White House on June 4, 2025.

Anna Moneymaker | Getty Images News | Getty Images

Republicans proposed offering a tax break to tipped workers, as part of a package of tax cuts the Senate Finance Committee unveiled Monday. GOP lawmakers are trying to pass their multitrillion-dollar megabill in coming weeks.

The Senate measure — which aims to fulfill a “no tax on tips” campaign pledge by President Donald Trump — is broadly similar to a provision that House GOP lawmakers passed in May as part of a domestic policy bill.

In both versions, the tax break is structured as a deduction available on qualified tips. The Senate legislation defines such tips as ones that are paid in cash, charged or received as part of a tip-sharing arrangement.

Taxpayers — both employees and independent contractors — would be able to claim it from 2025 through 2028. Filers could take advantage whether they itemize deductions on their tax returns or claim the standard deduction.

Key differences in ‘no tax on tips’ proposals

However, the Senate proposal is different from the House version in two key ways, Matt Gardner, senior fellow at the Institute on Taxation and Economic Policy, wrote in an e-mail.

First, the Senate legislation would cap the tax deduction at $25,000 per year, while it is uncapped in the House bill, Gardner wrote.

Also, the income limits work differently in the Senate legislation, he wrote.

The House bill makes the tax deduction completely unavailable once an individual’s income hits $160,000 per year.

By comparison, the Senate bill would gradually reduce the value of the tax deduction once an individual’s income exceeds $150,000, or $300,000 for married couples. The Senate would dilute the tax break’s value by $100 for every $1,000 of income over those thresholds.

More from Personal Finance:

‘SALT’ deduction in limbo as Senate Republicans unveil tax plan

How to protect financial assets amid immigration raids, deportation worries

What a Trump, Powell showdown means for your money

Senate Republicans, like those in the House, would limit the tax break to tipped workers in occupations that “customarily and regularly” had received tips on or before December 31, 2024.

The bill text directs the U.S. Treasury Secretary to publish a list of those occupations within 90 days of the legislation’s enactment.

Few workers would benefit from ‘no tax on tips’

A “no tax on tips” proposal seems to have bipartisan appeal in the Senate, which unanimously passed a similar standalone measure last month. Former Vice President Kamala Harris also supported a tax break on tips during her 2024 presidential campaign.

However, the tax break wouldn’t benefit many workers, tax experts said.

There were roughly 4 million workers in tipped occupations in 2023, about 2.5% percent of all employment, according to an analysis last year by Ernie Tedeschi, director of economics at the Budget Lab at Yale and former chief economist at the White House Council of Economic Advisers during the Biden administration.

Additionally, a “meaningful share” of tipped workers already pay zero federal income tax, Tedeschi wrote. In other words, a proposal to exempt tips from federal tax wouldn’t help these individuals, who already don’t owe federal taxes.

“More than a third — 37 percent — of tipped workers had incomes low enough that they faced no federal income tax in 2022, even before accounting for tax credits,” Tedeschi wrote. “For non-tipped occupations, the equivalent share was only 16 percent.”

Tax deductions reduce the amount of income subject to tax (or, taxable income) and are generally more valuable for high-income taxpayers relative to tax credits.

The Economic Policy Institute, a left-leaning think tank, said it believed a better way to help workers would be to raise the federal minimum wage.

A “no tax on tips” provision “gives the illusion of helping lower-income workers — while the rest of the legislation hands huge giveaways to the rich at the expense of the working class,” EPI economic analysts wrote Thursday.