D3sign | Moment | Getty Images

Women who invest began at an average age of 31, but most wish they had started putting money in the market earlier, a recent survey said.

Nearly all — 90% — of the women investors surveyed said they’re “on the right track” to achieve their financial goals, according to the survey, by Charles Schwab, an investment and financial services firm.

However, 85% share a common regret — they said they wish they had started investing at an earlier age, the survey said.

When the age is broken down by generation, Schwab found that millennials began investing at age 27, on average, Gen Xers’ average starting age was 31, and baby boomers started at an average age of 36.

Schwab polled 1,200 women in the U.S. ages 21 to 75 in January. The report said they each had at least $5,000 in investable assets, not including retirement accounts or real estate, and were all primary or joint household financial decision-makers.

Some of the top reasons respondents said they began investing later in life than they would have liked were a lack of financial knowledge, 54%, and limited funds to invest, 53%, according to Schwab’s report.

There’s an advantage in getting started with investing as soon as you can, even if you don’t have much to contribute at first: You’ll benefit from time in the market, according to Carolyn McClanahan, a certified financial planner and founder of Life Planning Partners in Jacksonville, Florida.

“Start saving while you’re young because you have lots of years for your money to grow,” said McClanahan, a member of CNBC’s Financial Advisor Council.

‘It’s a get-rich-slowly scheme’

An early start to investing harnesses the power of compounding.

Compound interest means your money earns interest on both the original amount you invest and on the interest you’ve already earned, said Jeannie Bidner, a managing director and head of the branch network at Charles Schwab. Compound returns are broader, and typically include other types of investment gains, such as dividends and capital gains.

Compounding creates a “snowball effect” for your cash, she said. “The sooner you get started, the better.”

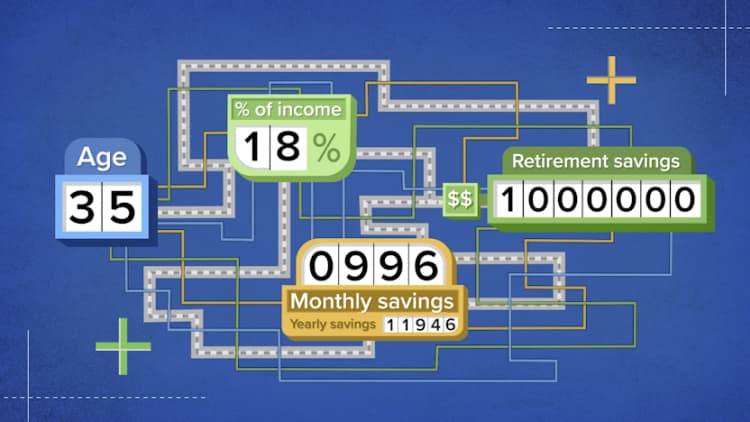

Let’s say a person begins at age 25 investing $6,000 per year, with an average 7% annual return. By the time they’re 67 years old, the account balance would be almost $1.5 million, according to Fidelity Investments. If that individual delays starting to invest until age 30, they would end up with just over $1 million by retirement.

In other words, that five-year head start offers a bonus of nearly half a million dollars.

It’s not just about getting a head start. Staying invested through major market swings and sticking to your plan are essential to meeting your financial goals.

More than half, or 58%, of the women in the survey said they learned to stay invested despite the ups and downs of the market, Schwab found, and 42% said they learned to create a plan and stick to it.

While market volatility can “feel like you’re at a casino,” it’s important to disregard the major swings and focus on your long-term outlook, Katie Gatti Tassin, author of “Rich Girl Nation: Taking Charge of Our Financial Futures,” said at an event Wednesday at 92NY, a cultural and community center in New York.

“It’s not a get-rich-quick scheme, it’s a get-rich-slowly scheme,” Gatti Tassin said.