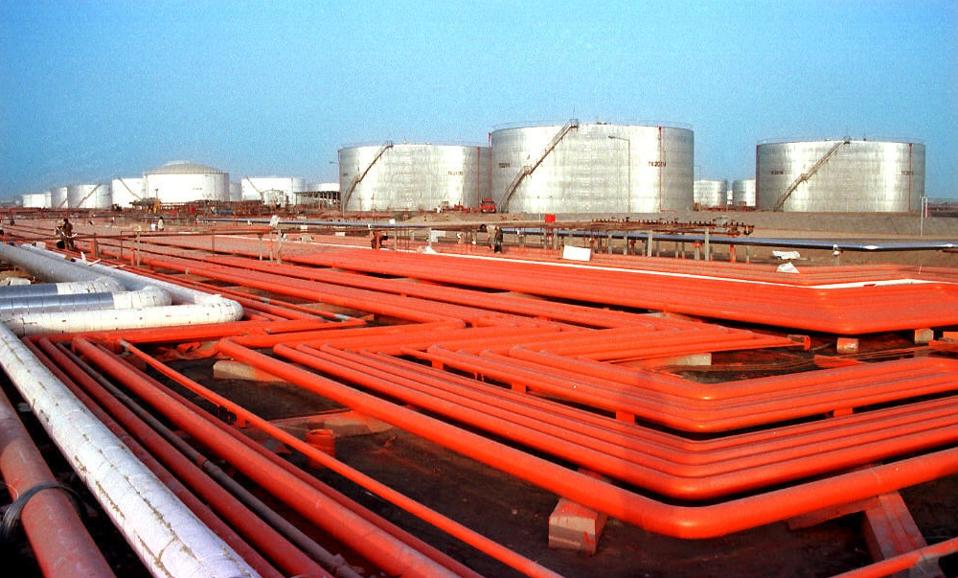

An Iranian oil refinery in the industrial Gulf port of Bandar Abbas. (Photo: Jamshid Bairami)

AFP via Getty Images

Oil prices surged past $70 per barrel on Friday, following heightened tensions in the Middle East as Israel struck Iran overnight with what the Jewish nation described as strategic strikes on Tehran’s nuclear capabilities and leadership.

At 8:36 am EDT on Friday, the global proxy benchmark Brent’s Front Month Crude Oil futures contract was up 7.81%, or $5.42 to $74.78 per barrel, while the West Texas Intermediate Front Month contract traded at $73.81 per barrel, up 8.48% or $5.77. Prices were trading sideways in the week prior to the latest escalation between Israel and Iran.

Israeli Prime Minister Benjamin Netanyahu said his country’s forces had struck nuclear and military targets deep inside Iran. Strikes targeted sites in Arak and Isfahan, as well as Iran’s main uranium enrichment site Natanz and its capital Tehran.

According to media reports, Israeli attacks also killed Iran’s senior military leaders and nuclear scientists including Hossein Salami, commander-in-chief of the Islamic Revolutionary Guards, Gholamali Rashid, commander of Khatam-al Anbiya Central Headquarters, Fereydoon Abbasi, nuclear scientist and former head of Iran’s Atomic Energy Organization, Mohammad Mahdi Tehranchi, another nuclear scientist allegedly involved in Iran’s nuclear weapons program, and Mohammad Bagheri, chief of staff of Iran’s armed forces.

Iranian officials described the Israeli attacks as an act of war and launched around 100 drones in retaliation. However, the situation is expected to deteriorate further as Netanyahu gave a public speech saying Israel’s military action may last several days. In that circumstance, Iran’s retaliation will likely continue too.

The shock factor has upped crude prices, which have struggling to gain any sort of lasting upward momentum. Oil futures are currently down by over 10% on last year despite the latest spike, and Brent futures haven’t traded above $70-levels since April 3.

How A War Between Iran And Israel May Impact Oil Prices

Crude oil production volumes outside the Middle East continue to remain elevated, with the U.S. currently being the world’s largest oil producer. Production from Brazil, Canada, Guyana and Norway continues to edge higher.

It implies that global oil demand growth — currently projected just north of 1 million barrels per day — can currently be serviced by production outside of the Organization of the Petroleum Exporting Countries. Furthermore, the current market conditions are similar to the last round of Israel-Iran hostilities in 2024, when Netanyahu’s administration did not target Iranian energy infrastructure.

In contrast, Iran’s energy infrastructure was routinely targeted by Iraqi dictator Saddam Hussein during the Iran-Iraq war (1980-88), which severely crippled the Iranian economy. While the prominent oil industry makes such locations obvious potential targets for Israel, that doesn’t necessarily mean it would take them out. Were it to do so, the move will likely have an impact on the global oil market to varying degrees.

The most potentially devastating Israeli strike carrying global implications would be an attack on the Kharg Oil Terminal. It would likely result in a further short-term crude price spike of around 5%, as it carries the potential for international disruption, primarily to Iran’s exports to China — the world’s largest importer of oil.

On the other hand, an attack on Hormozgan oil facilities would likely be more about symbolism given that many of the province’s terminals are largely unused. This is down to creaking infrastructure, lack of investment and years of Western sanctions on Iranian oil. Israel may attack the province to send a message.

Should the Abadan Refinery be targeted, it would cripple Iran’s domestic fuel supply chain. It being knocked offline perhaps does not carry any significant international implications. However, should the nearby Mahshahr Oil Terminal be subjected to an Israeli strike, regional crude and product supply chain issues will likely arise.

All things considered, in the absence of any such disruption to Iranian energy infrastructure, the current risk premium will likely fizzle out and market fundamentals will return to drag oil prices back to levels seen prior to the escalation of hostilities.