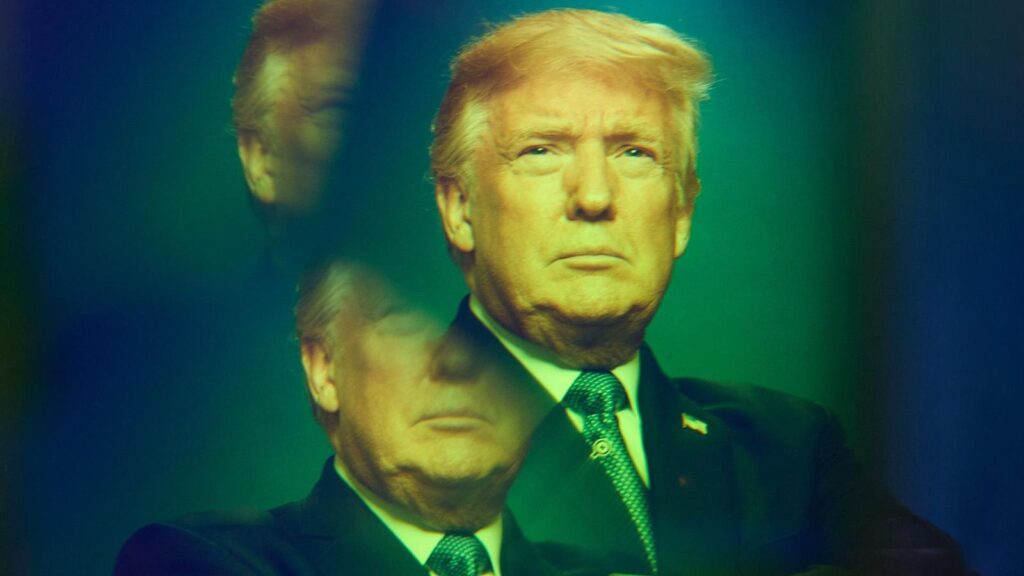

A new Forbes survey of Wall Street heavyweights shows many who supported Trump’s economic promises have abandoned him – and a vast majority disapprove of the President’s economic policies.

More than two months into Donald Trump’s term, with details of his “Liberation Day” regimen revealed this week, Forbes reached out to 50 top Wall Street leaders, including billionaire investors, major institutional asset managers and the nation’s largest wealth advisors, to gauge their support for the president’s economic strategies.

The 50 respondents, chosen for their outsized influence, reinforced the recent market tumult. Among these Wall Street heavyweights – more than half of whom supported Trump’s economic policies as he reentered the White House in January – 72% say the Trump team’s economic plan has been ineffective, and 66% did not support his economic policies. Among those who were Trump supporters as recently as a few weeks ago, more than one-third now no longer back his economic policies, and a majority of them—54%—say he is failing in the execution of his plan.

Forbes also polled these Wall Street bigs about specific aspects of Trump’s approach to various economic policies asking them to rank them on a scale of 1 to 5, with five being the most favorable.

Their grades are largely awful. On tariffs, Trump rated a 1.86 out of 5, with 27 respondents assigning the lowest rating possible. On the stock market, a similarly lousy 1.96 (with 25 respondents assigned him a 1 out of 5), and a near equally bad 2.10 for his executive orders aimed at law firms – a direct shot at the rule of law that underpins America’s free enterprise system. Ratings on cryptocurrencies (2.0) and inflation (2.16) offered no solace.

Two (relatively) bright spots: Trump’s scores on deregulation (3.08) and his Elon Musk-led government cost cutting agency DOGE (2.96).

This aggressive new trade policy has sent shockwaves through the global economy. Trump’s plan is centered around what his administration calls “reciprocal tariffs”—imposing a baseline 10% tariff on all goods imported into the United States, but goes much further for many of America’s largest trading partners, hitting them with tariffs far stiffer than the ones they have in place.

Global stock markets plunged the day after the announcement, with major indexes across Europe, Asia, and the United States seeing steep declines. U.S. markets faced their biggest one-day loss since 2020, with the S&P 500 down 4.8%, The Dow Jones Industrial Average by 4% and the tech-heavy Nasdaq down 6%. The U.S. dollar fell more than 1% versus major currencies including the euro and the yen.

“It’s alarming and unsettling,” says Anh Tran, managing partner at California-based SageMint Wealth (featured on the Forbes Shook Top Wealth Management Teams list), which manages $350 million for clients. “Everyone is now thinking about how to create downside protection.”

When it comes to tariffs, Trump has defended the move by arguing that other nations have long taken advantage of the United States through what it claims are unfair trade practices. However, many economists have cast serious doubt on the administration’s methodology for calculating these discrepancies, noting that trade agreements often involve complex factors that go beyond headline tariff rates.

In a recent note, Morningstar’s chief U.S. economist, Preston Caldwell, called Trump’s tariff hikes a “self-inflicted economic catastrophe” for the country. “If the tariff hikes are maintained, they will permanently reduce U.S. real GDP, and hence real living standards for the average American,” he wrote. The last time the U.S. instituted such sweeping tariffs was nearly a century ago in 1930 with the Smoot-Hawley Tariff Act, which triggered a global trade war and ultimately led to the Great Depression.

“Investor psychology has been destroyed.”

The brunt of Trump’s tariffs will be felt by the U.S. consumer in the form of higher prices on everything from groceries to gas. UBS analysts estimate that U.S. GDP growth may fall below 2% this year (down from 2.8% real GDP growth in 2024), while Deutsche Bank estimates the impact could be even worse.

“Expect lower growth and earnings forecasts, with added upside risk to inflation,” says Adam Turnquist, Chief Technical Strategist for LPL Financial. “This is not a good combination for equity markets.”

Certain industries will be harder hit than others. While automakers appear to have been largely spared in this round of tariffs—thanks to existing protections and incentives—retailers, particularly those in the clothing and apparel sector, are bracing for significant disruptions. With many U.S. retailers relying heavily on imports from countries like China and Vietnam, the steep new tariffs will undoubtedly lead to higher consumer prices.

With markets in turmoil and businesses scrambling to adapt, Wall Street is losing faith in Trump’s leadership. Says Chris Zaccarelli, chief investment officer for North Carolina-based Northlight Asset Management, which has $450 million in assets: “Few people would have predicted that all of the optimism from last year would evaporate in two short months.”

“Investor psychology has been destroyed, and dip buyers are nowhere to be seen,” according to a recent investors note from Vital Knowledge founder Adam Crisafull. “All the efforts to spin recent events positively are increasingly falling flat.”

More From Forbes